Phuket Residential Market Research H2 2018 (CBRE)

Phuket real estate market develops due to rental programs

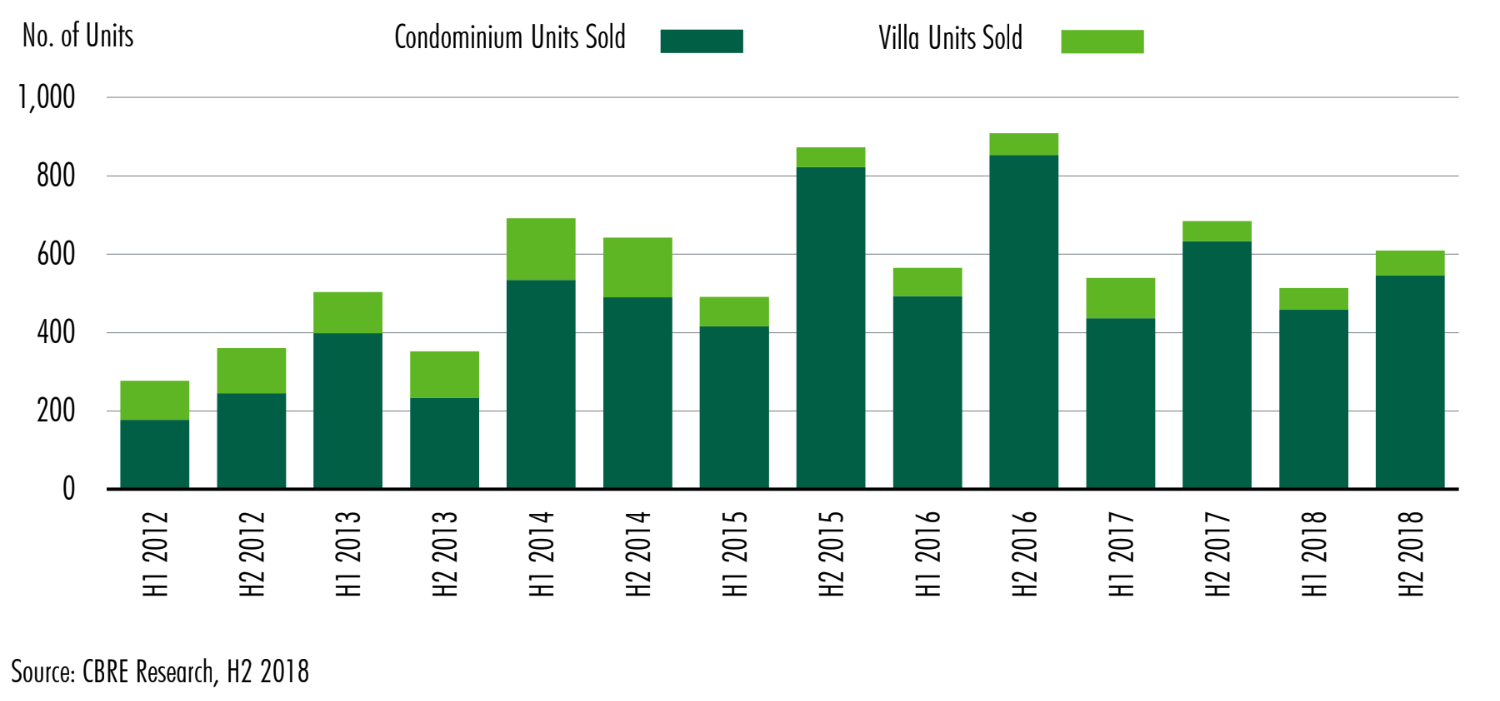

Diagram 1: amount of condominium and villa units sold in 2012-2018 divided into 6 months periods

6 months report highlights (H2 2018) – villas

- Total amount of sold villa units: 63 villas, 21% more than previous year.

- Demand in rental return increases sales. 92% of sales are villas with the price under 1 million USD.

- Almost 5 villa units with the price over 1 million USD were sold during this period.

- 5 new villa developments were launched in the price segment under 1 million USD for villa.

6 months report highlights (H2 2018) – condominiums and apartments

- Total about 550 apartments were sold in the 2nd half of 2018 what is 13.7% less than previous year.

- 80% of condominiums sold in the 2nd half of 2018 had rental program.

- Customers buying apartments in each price segment were intended to live in purchased apartments up to 60 days per year.

- In the 1st half of 2018 two condominiums with hotel conception were launched: VIP KATA Condominium 1st Phase, Wyndham Naiharn Beach. Most of apartments in these condominiums are estimated under 250 000 USD.

CBRE Phuket Residential Market Research

During the 2nd half of 2018 546 condominiums and 63 villas were sold. It is 13% less than previous year (for condominiums) and 21% more than previous year (for villas).

Sales are based on investment return: property – both villas and condominiums – should bring income.

Investors more often prefer to buy apartments because they are cheaper and offer rental programs. The price of most purchased apartments is under 250 000 USD.

Condominium customers mostly come from China, Hong Kong, Singapore, Russia. Even though in the middle of the year there was a significant fall in tourist flow from China, it didn’t influence property sales. However, in December 2018 tourist flow from China increased by 2.8% in comparison to the previous year.

It is expected that demand for property managed by hotel chains will continue to grow.

In 2018 3 villas were sold in the price segment over 3 million USD and 29 apartments were sold in the price segment over 600 000 USD.

Today real estate market is aimed mostly at China and Russia what has a risk of instability in the market and leads to a challenge for property development companies to share sales among customers from other countries.

Phuket9 Company Comments

Possible sales crisis

Today there are more than 50 condominiums for sale in Phuket with total 10000 apartments. According to CBRE report about 1000 apartments are sold in Phuket every year. If sales are conducted with the current pace, it will take about 10 years to sell out all projects. We don’t exclude the possibility of increasing demand but statistics shows that maximum amount of apartments sold yearly is 1500 (2015-2016).

Analytical department of Phuket9 company follows current condominium and villa development in Phuket. All announced projects are registered in the list of Phuket condominiums with all data needed for market analytics including starting prices and construction periods.

Need to note that most listed condominiums are not under construction yet and are sold before construction works start. Together with sales dynamics and demand this carries some risks for project implementation. Already now there are projects with delayed start-up dates of construction works and completion.

High rent competition

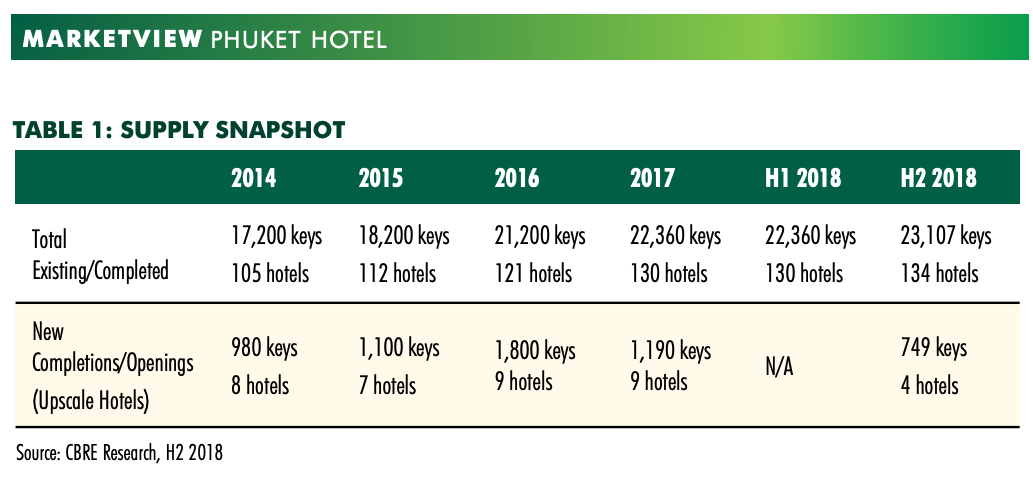

According to CBRE report in hotel sphere 134 hotels were launched in Phuket with total amount of rooms 23000 by the end of 2018.

- In 2018 tourist flow from all over the world grew by 4%. However in the middle of the year tourist flow from China decreased by 12% each month from August to November. In December it grew again by 2.8%.

- In the second half of 2018 hotel occupancy was 67.3% what is 9.4% less than last year.

- Average price per night also fell by 9% from 3610 THB to 3285 THB.

- In the second half of 2018 4 new hotels were launched, total amount of rooms – 749.

- In general by 2021 hotel room supply of Phuket hotels will grow by 31% – 27 new hotels are under construction now, total amount of rooms – 7163.

There is going to be a competition between completed hotels and hotels under construction. It will bring some difficulty to developers offering rental programs. Taking into consideration the fact that within 2 years real estate market will gain more than 7000 hotel rooms and more than 10000 apartments, seller’s market will increase twice. For today hotel occupancy rate is 63% and this is the minimum rate to return. If during this period tourist flow will not grow by 30-40%, real estate market will face difficulties.